Fintechs: Moving back to bundling from unbundling?

Fintech got foothold by unbundling from BFSI, are they back to bundling horizontal for growth?

Fintech drove the financial services industry transformation by adopting to consumer digital experience expectations and data-driven innovations. Traditional universal banking providers were more focused on meeting regulations/compliance and few invested in digital innovation teams (checkmark to boards). However, markets are fast-moving and it appears that Fintech is on a path of rebundling financial services. Till now revenues and market share of all participants have increased, but if there are universal Fintechs (or a Big Tech jumps in), then the financial services market is going to structurally change for benefit of consumer.

BFSI were driving to become Universal Financial Service Provider – all in one shop

Providers strived to offer bundled products and services on disparate, legacy platforms, Individual LOB platforms, individual consumer facing SoR, few common Platforms, LOB infra platforms - structured around bank’s delivery channels

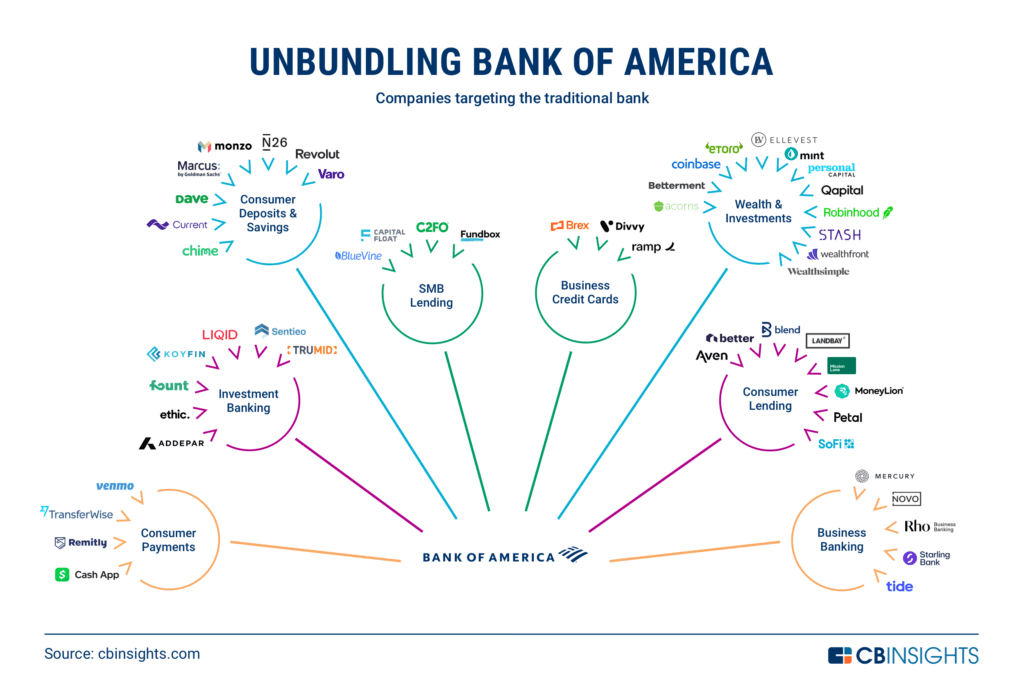

FANG++ set consumer’s digital expectations Fintech understood consumer pain, addressed friction points, and unbundled banks by offering any-time, any-where, any-device delivery of its services

Fintech unbundled the leaders in BFSI by:

- Offering mobile first experience

- Hyper focused on single use-case/market/experience

- Focused Targeting (Underserved, Student, Fractional use, Student, near-prime, usage based)

- Algorithmic (Robo advisory, lower costs)

- API’s, Microservices, Cloud Native, no legacy, User Centered Design

- Avoid Multiple Apps/websites to visit- no longer fragmented customer journey

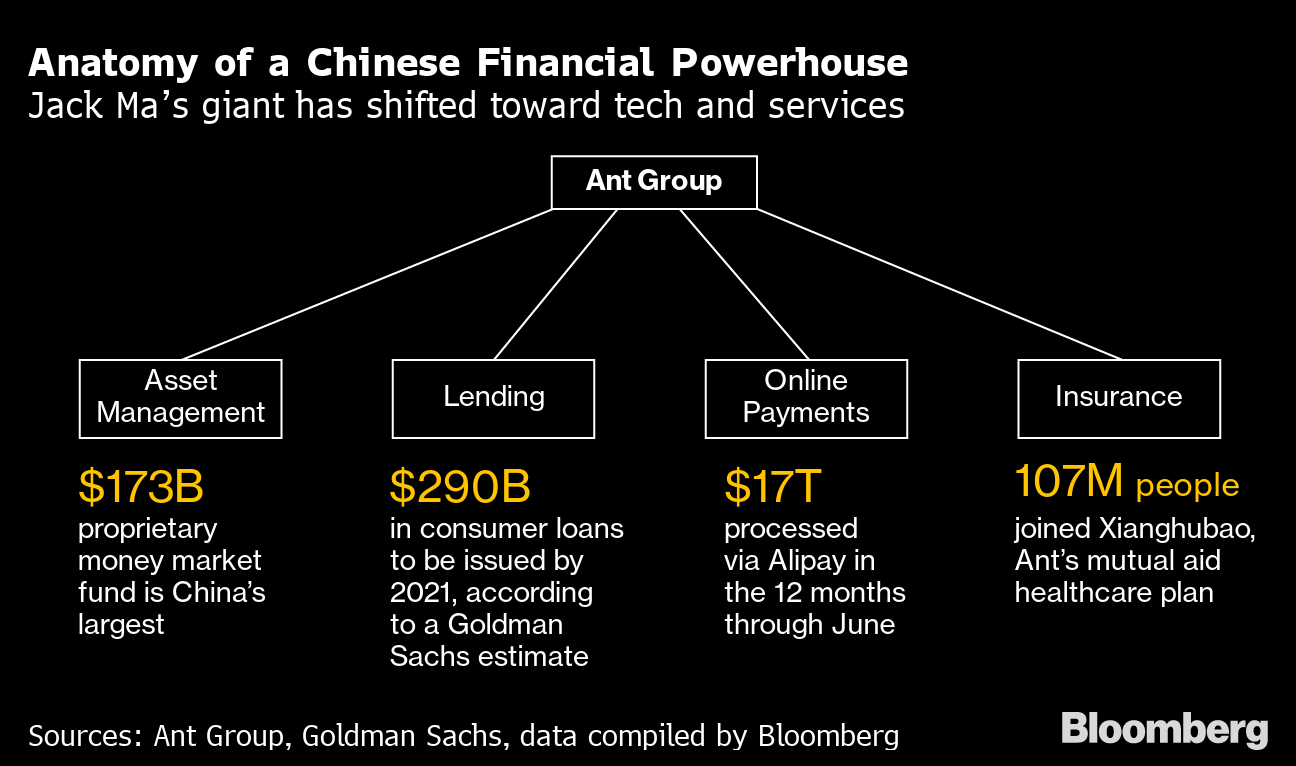

Fintech moving to bundling more offering

Having established a customer base, fintech’s are now growing their offerings and looking more like tradition BFSI providers. BFSI providers are also creating inhouse/partnering fintech to grow to become Universal service provider. Interesting to watch how a major tech companies gets regulatory approval to challenge.

Fintech Way

- Start and establish one service and establish consumer relationship

- Capture consumer data, enrich consumer identity, build own AI/credit scoring data model

- Leverage own data models to rebundle services around the consumer

- Leverage open standards – Open Banking, PSD2 or establish them to take leadership

- Few breakout fintech 2.0 – Ant, GS-Marcus, SoFi, Stripe, Square