Game Changer - Digital Mortgages roiled banks' decades-old model of retail lending

Digital mortgages have met borrowers demand for speed and convenience, rewrite the retail banking model, and blur the distinction between fintechs and traditional banks

Mortgage Industry is the best example of technological innovation leading to dis-intermediation and dramatic growth of non-bank mortgage lending after the global financial crisis. Non-bank lenders have become dominant in the mortgage market, after banks retreated and became risk averse, and not scale/be elastic per business demands.

FinTech lenders process mortgage applications much faster than traditional banks. Faster lending has not increased defaults, help increase refinancing and at the same time not biased/predatory to marginal borrowers.

Transforming to a digital lending model drives quantifiable bottom line impact by expanding & accelerating the sales funnel while reducing costs through greater process efficiency.

Technology improved

- Sales Productivity (based of MarTech, Dialer)

- Pull Through Rate

- Cost to Originate and Fulfill

- Cost to Serve

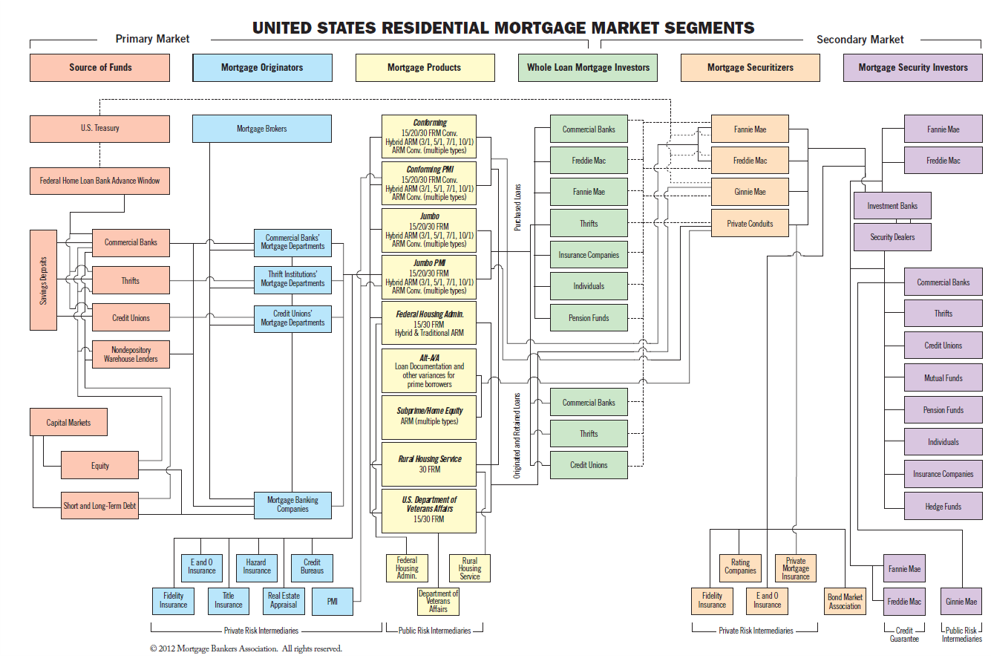

Mortgage Bankers Association (MBA) has a good representation of USA Residential Mortgage Market Segments:

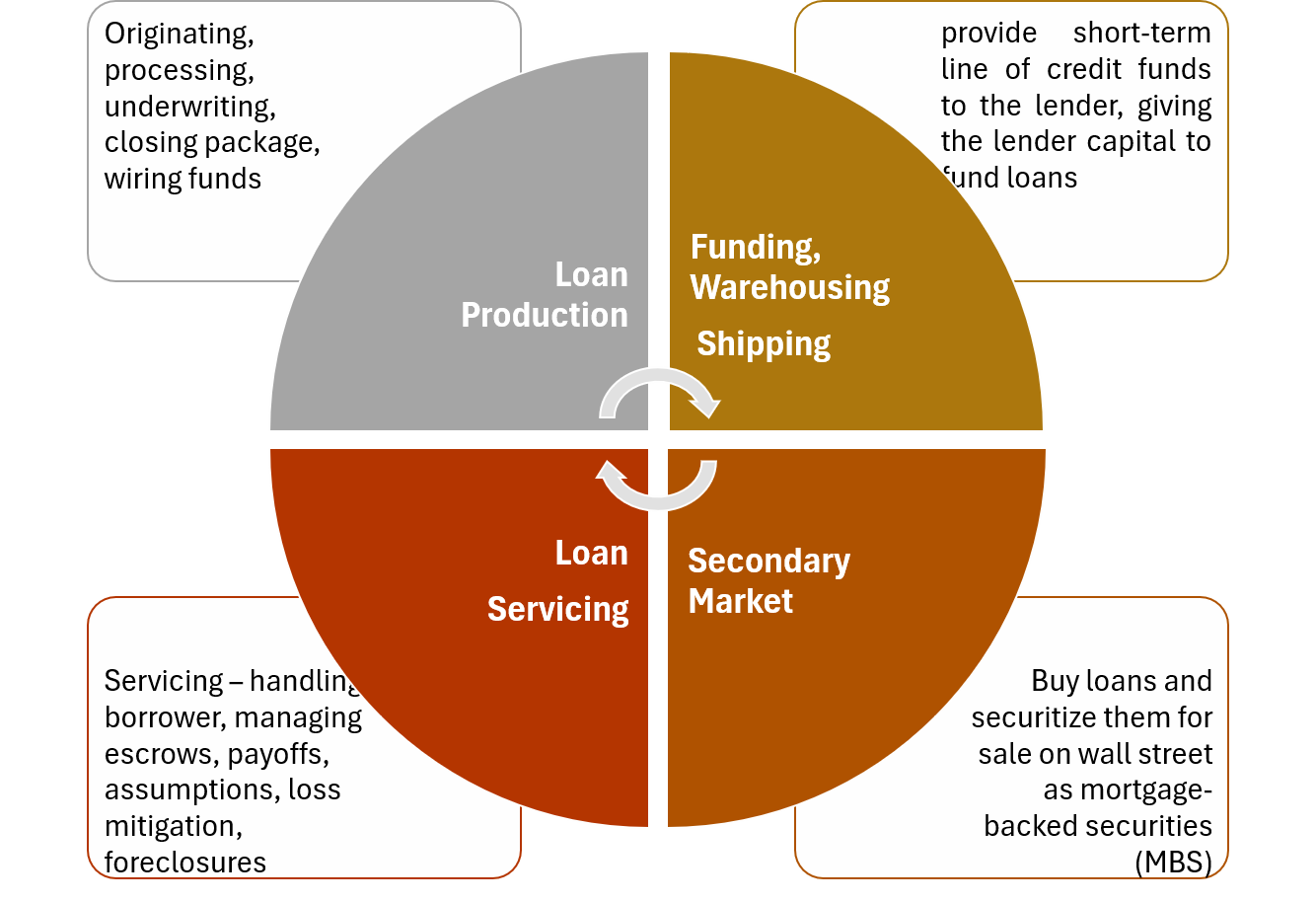

Residential Lending - Functional Overview:

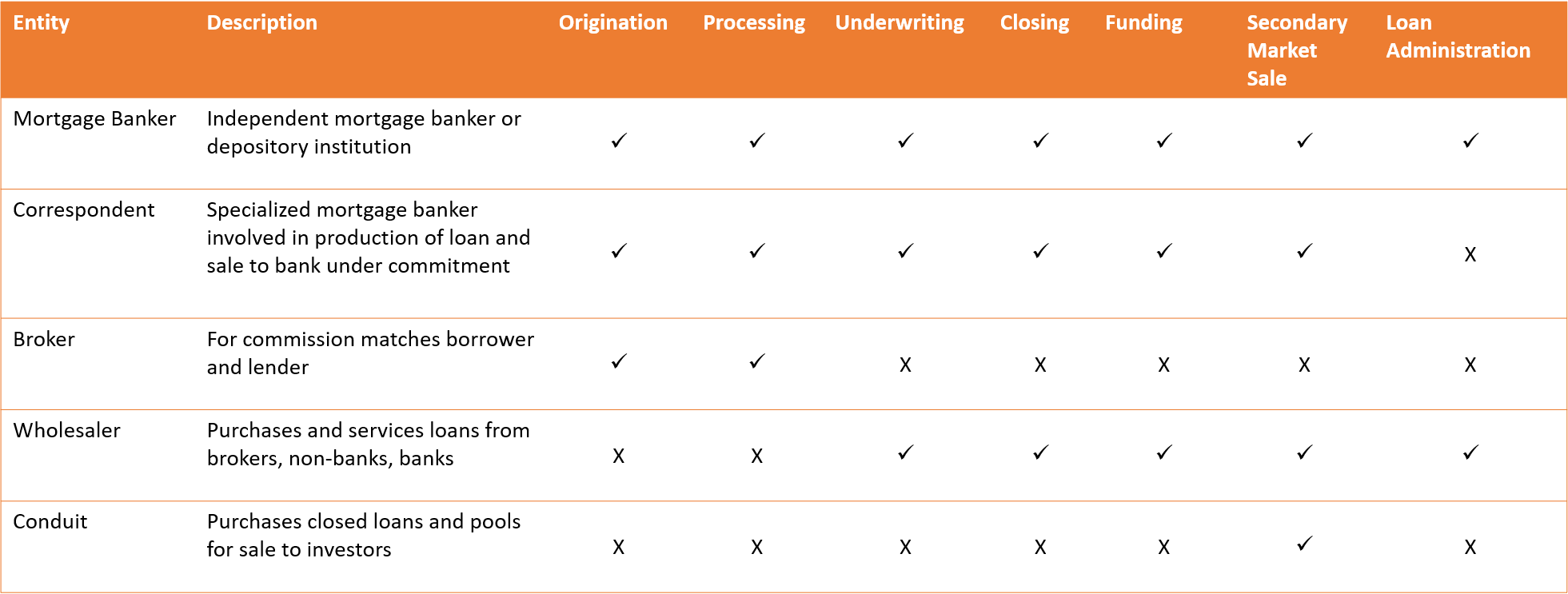

Types of companies involved in Residential Mortgage Industry:

My foundational MBA learning/certifications

- 100.1 – introduction to Mortgage Banking

- 100.2 – Loan Production Basics

- 100.3 – Funding, Warehousing, Shipping and QC Basics

- 100.4 – Secondary Marketing Basics

- 100.5 – Loan Administration Basics

- 201.01 – Introduction to Fair Lending