Open Banking: Allowing consumers access to their financial records

Allowing consumers access to their financial records will lead to digital transformation of BFSI industry

Towards end 2020 Consumer Financial Protection Bureau (CFPB) issued an advance notice of proposed rulemaking (ANPR) related to consumer’s access to financial records that will eventually become a law. It seeks to establish US framework for Open Banking / Open Finance. This will create a financial ecosystem that enhances consumer financial lives, increase competition for financial service provider, & enable innovative products and services from disruptors/fintechs.

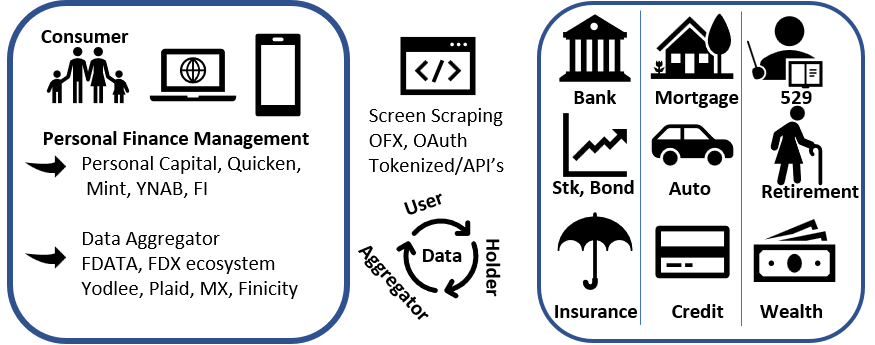

Apart from ‘Consumers’ themselves, the participants in this ecosystem will be data holders, data users, and data aggregators’.

Innovative Banking, Financial Services, Insurance (BFSI) companies may decide to play one or all roles. Just staying as a data holder will put squeeze on margins. We will see multiple innovative use cases for authorized data like:

Personal financial management (PFM) dashboard that allows consumers to have a single view of complete financial health. No need to log onto multiple service providers; mitigating phishing scams; consumer browser being least secure. Dashboard will allow shopping for and selecting new products/services; get best savings rates, credit profile improvement, permission - based transactions, payments and money transfers

Easier and secure way to allow Identity Verification, Account Ownership Verification, Digital Account Open, Transfer of Assets, pre-population of KYC

Allow consumers to share information with advisers/wealth managers and make investment decisions, retirement planning, wealth/tax management

Innovation and newer methods to establish creditworthiness/underwriting. Lender will be able to see overall cash flow and identify suitable product/rates. Greater assurance of data accuracy and reliability

Simplify/reduce time involved in large asset purchase cycle (mortgage, investment property); lender can improve its products by using authorized data access to verify digitally an applicant’s account assets. The consumer is spared the burden of assembling these data and may be able to proceed faster as a result

Offer new services - use near real-time account data to provide a consumer with short-term credit options that compete vis-a-vis checking account overdraft functionality and pricing

Phone number-like portability, automated switching of products (e.g. insurance/ loans) reducing the current friction and improving the ability to shop around without leaving Personal Financial Management (PFM) dashboard