Launching a prepaid card program

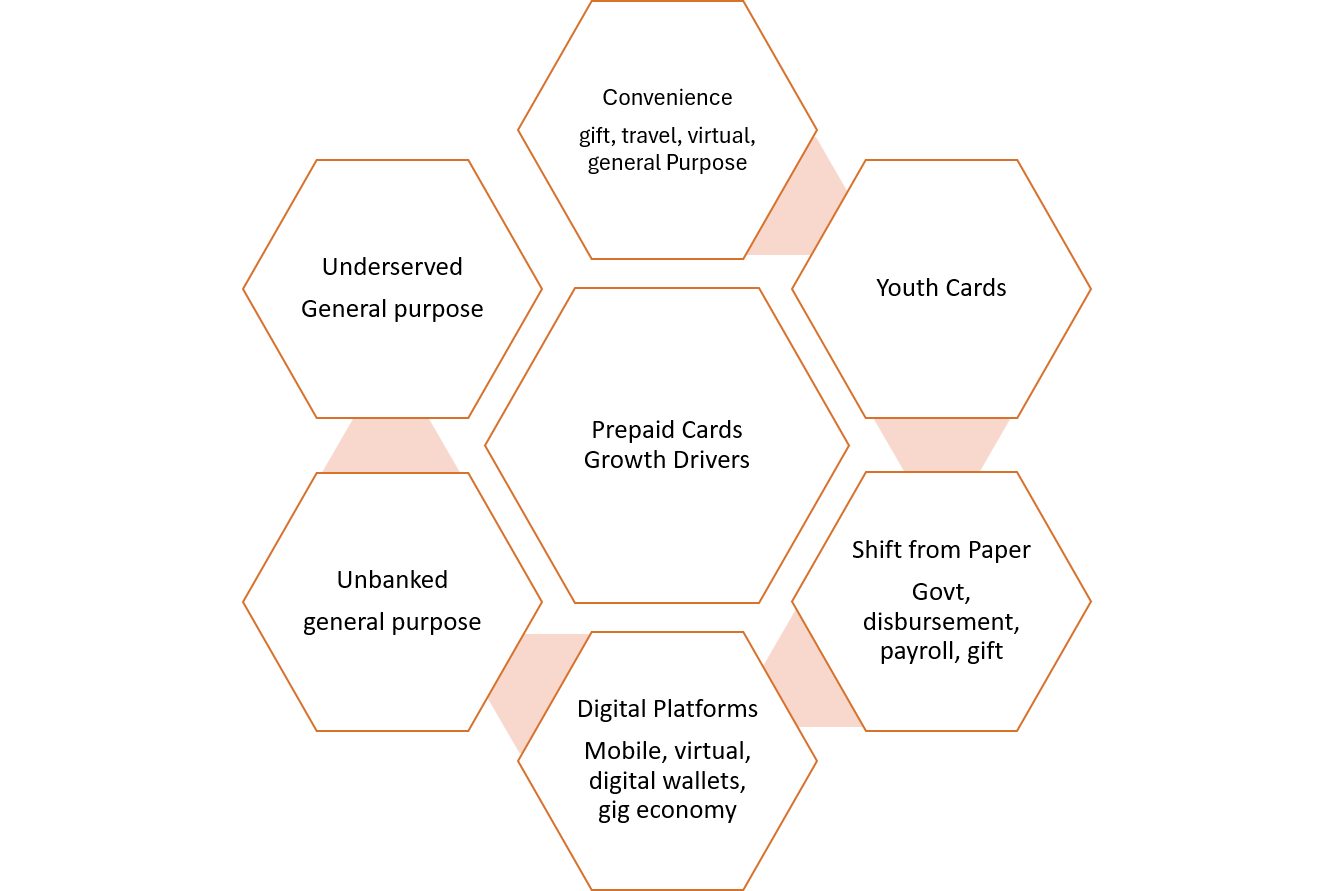

Prepaid is a fastest growing product category for payment networks & non-financial providers. Prepaid cards are becoming a universal payment vehicle to address many different needs in the global marketplace.

General Purpose Reloadable (GPR) prepaid cards are a vital financial product catering to various market segments.

Prepaid cards enable users to enjoy the benefits of credit and debit cards, such as paying bills, buying gas, and transferring money, without incurring new or additional debt. They also help users develop new financial management skills.

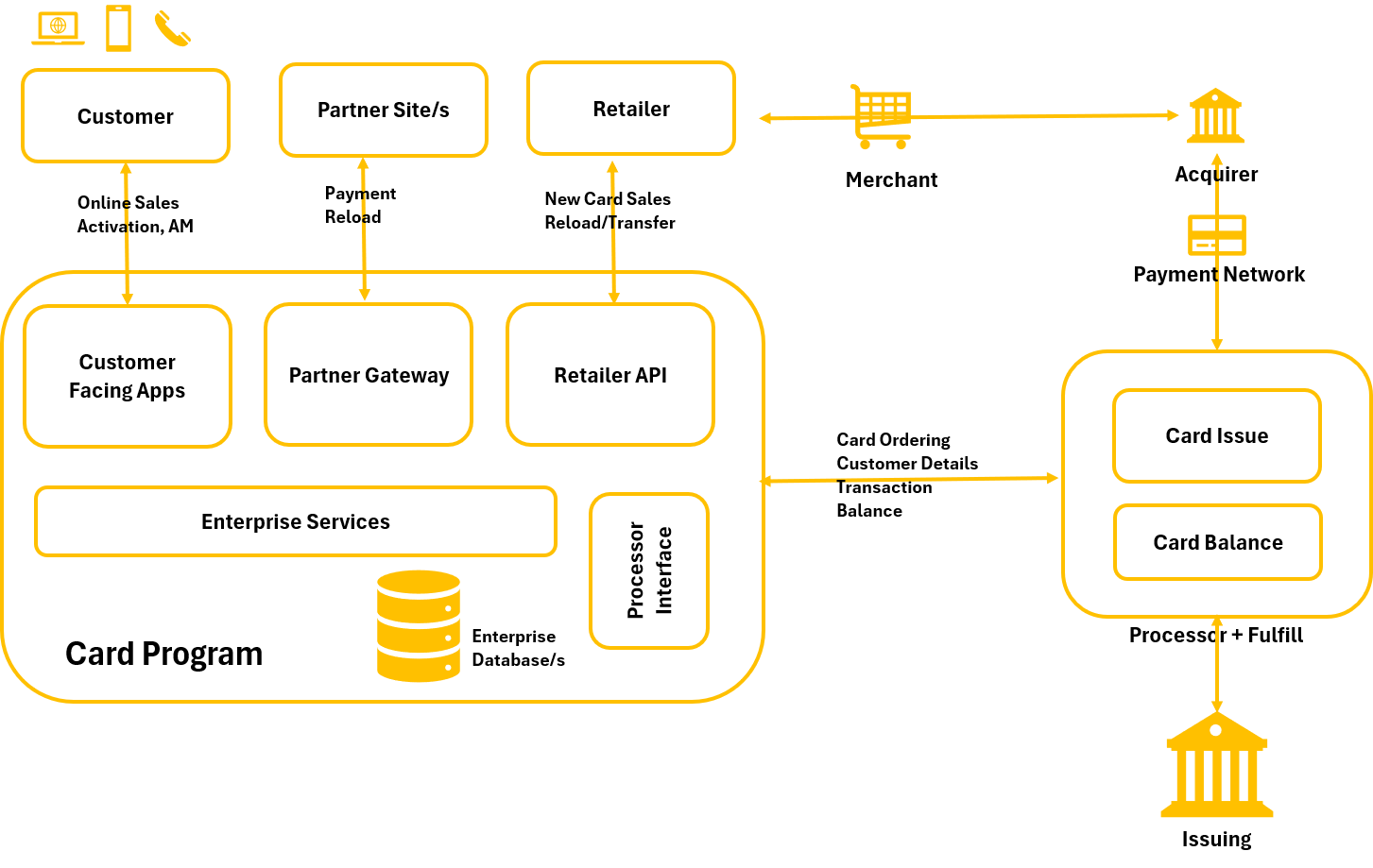

Many companies initially sell their prepaid cards through retailer partnerships or online. They are now expanding into embedded finance / Banking-as-a-Service (BaaS) to meet the needs of gig economy platforms. Revenue is generated through monthly fees, interchange fees on gross dollar value (GDV) transacted, and other transaction-based fees - ATM, transfer, and overdraft fees.

Increasingly, non-financial companies are exploring card programs to enhance customer loyalty and create new revenue streams. Consumer acquisition is relatively frictionless, either by taking cash to a retailer’s point of sale (POS) or through digital channels, when compared to traditional banks.

Launching a card product

Program/product design

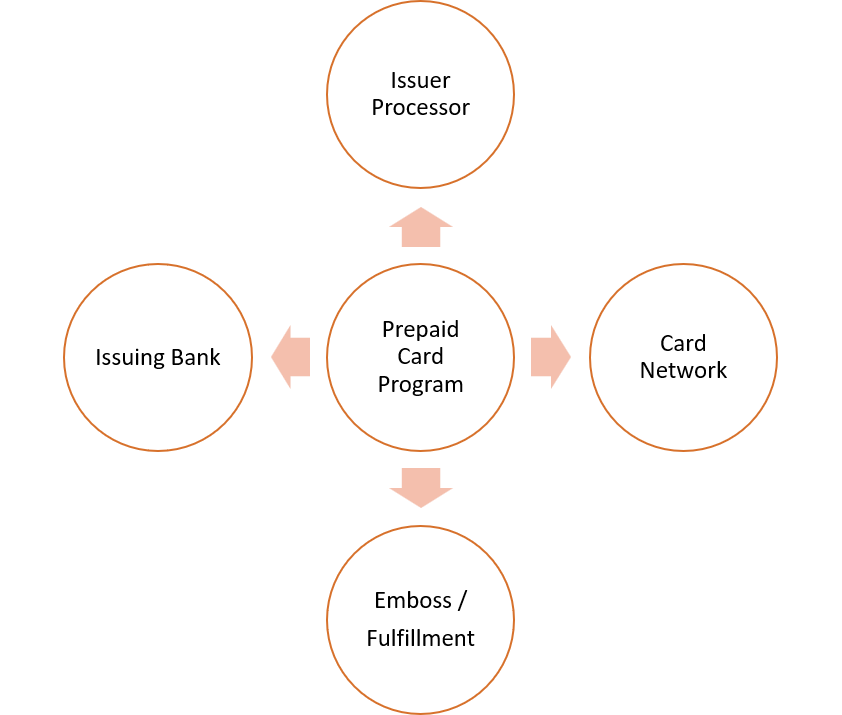

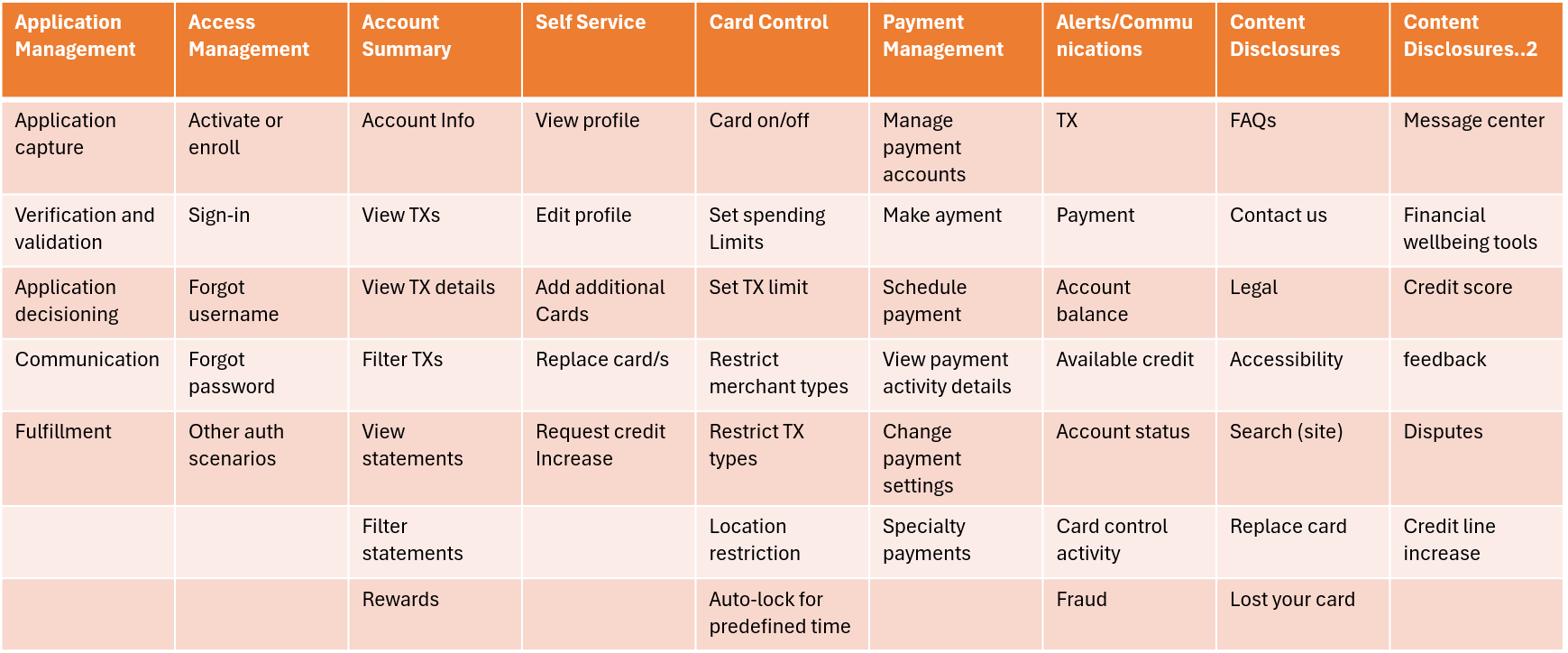

The process involves defining the structure, key features, customer benefits, target audience, and terms and conditions. It also includes selecting a card network (such as Mastercard or Visa) and designing the branding for both physical and virtual cards.

Issuance and account management

Issuance involves creating and distributing a card to customer, allowing them to pay for goods and services or earn loyalty points. This process includes BIN sponsorship, which enables organizations to process payments and offer cards without directly partnering with a card network. It also entails managing customers’ accounts, securely storing their personal information, handling inquiries, and resolving disputes or chargebacks.

Risk management and fraud prevention:

It’s crucial to implement a robust risk management and fraud prevention strategy to safeguard both card company and customers from the constant threats of fraud, identity theft, and data breaches. An effective strategy should incorporate transaction monitoring systems that utilize rules and machine learning to detect, flag, and potentially block suspicious activities. Additionally, security measures such as 3D Secure can help prevent fraudulent actions by requiring customers to complete two-step authentication.

Compliance and regulation:

Card programs must comply with important industry regulations, which help protect cardholders and maintain the integrity of the entire payments network. The main regulations are the Payment Card Industry Data Security Standard (PCI DSS), anti-money laundering (AML) requirements, and Know Your Customer (KYC) guidelines

Marketing and customer acquisition:

Success depends on the acquisition of new customers. Data Analytics helps find best cardholder, transaction and reconciliation data to help you segment your audience, understand their needs, etc and add new customers.

Customer retention, loyalty and other added value services:

In order to retain cardholders and long-term profitability, card holder need to be incentivized with value-added services like rewards, cashback, bill-pay and others

Reporting and analytics:

Reporting and analytics empower to assess the performance of card program and to make any necessary refinements or improvements. You should make sure to track transaction volumes, customer acquisition costs, and churn rates, and analyze your customer behavior and preferences.